Sorry, no search results could be found.

6 Nov 2025 | 5 minutes to read

Andrew Metcalf, Head of Fixed Income and Stephen Hayde, Managing Director share the latest market insights from the fixed income team on whether credit markets are showing signs of a bubble.

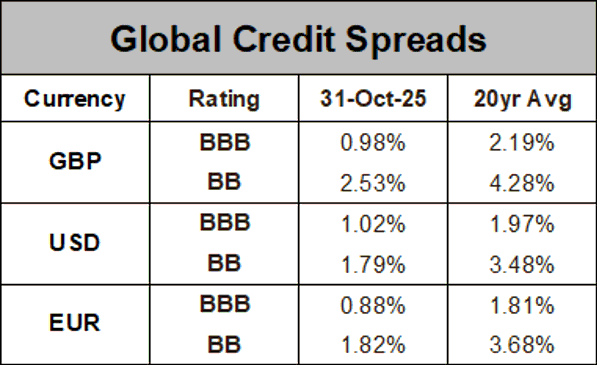

Credit spreads – the additional yield an investor receives for lending money to a company rather than a government for the same period – have been rich versus history for some time. However, October saw a significant number of events and milestones that more firmly lead us to believe that credit markets are now displaying bubble-like characteristics.

In October 2025, Artificial Intelligence (AI)-mania finally reached global bond markets – with faint echoes of the 1999 tech bubble. At the same time, growing investor concerns around private credit, coupled with increasingly complex bond structures and financial disintermediation to fund datacentre projects are reminiscent of 2007. Both factors attest to equity market bullishness finally leaking into credit markets.

While we cannot predict the future, we highlight the following events as evidence of bubble-like conditions in credit:

![]()

The TrinityBridge Select Fixed Income Fund is a nimble and proactive fund, and we have a strong track-record of patiently waiting for attractive buying periods to emerge. The same discipline applies to selling bonds during periods of irrational or unattractive valuations.

The Fund is a flexible, strategic bond fund. Unlike bond funds that operate with strict benchmarks (ie 80% of holdings must be in Investment Grade or High Yield credit), we have the freedom to allocate to Government bonds, credit – or any other bonds that we believe are attractive throughout the cycle. This freedom means that today, 54% of fund holdings are in Government bonds (versus 0% in 2019), and just 12% of the fund is invested in high yield and ‘unrated’ bonds (versus 60% in 2019).

Whether or not we are in a credit bubble, three things are key: sticking with a sound and disciplined research process, nimbleness and patience.

Our fundamental and proprietary research means that we only invest in bonds that we understand well – and at valuations we consider attractive.

And although Select Fixed Income is a go-anywhere, ‘best ideas’ strategic bond fund, we do not invest in any forms of distressed debt, mortgage-backed securities, asset-backed securities, municipal bonds, or high yield bonds with a rating below BB-. We also eschew any costly derivative overlays.

Important information

These are the views of the co-managers of the TrinityBridge Select Fixed Income Fund. Andrew Metcalf is also the Head of Fixed Income for TrinityBridge. Stephen Hayde is also the fund manager of the TrinityBridge Diversified Income Fund.

The information contained in this article is believed to be correct but cannot be guaranteed. Past performance is not a reliable indicator of future results. The value of investments and the income from them may fall as well as rise and is not guaranteed. An investor may not get back the original amount invested. Opinions constitute our judgment as at the date shown and are subject to change without notice. This document is not intended as an offer or solicitation to buy or sell securities, nor does it constitute a personal recommendation. Where links to third party websites are provided, TrinityBridge accepts no responsibility for the content of such websites nor the services, products or items offered through such websites.

Before you invest, make sure you feel comfortable with the level of risk you take. Investments aim to grow your money, but they might lose it too.