Sorry, no search results could be found.

24 Oct 2025 | 5 minutes to read

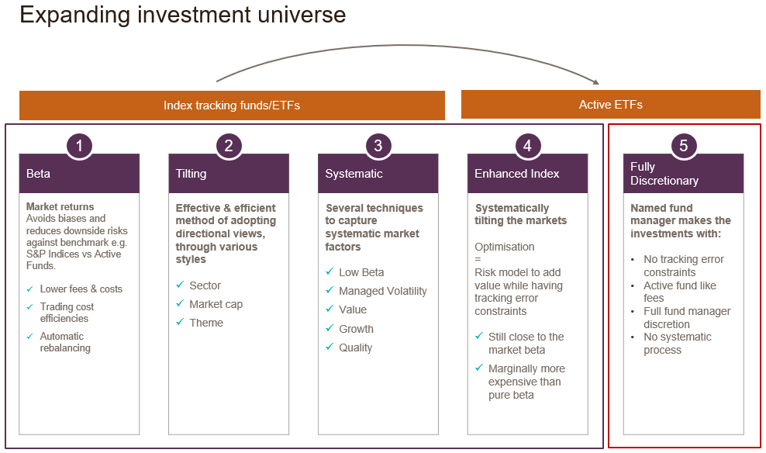

Exchange-traded funds (ETFs) have become one of the most popular investment vehicles the world over. The ease with which conventional ETFs are understood, their low fees, the provision of efficient market exposure, and wide availability have all contributed to their popularity. ETFs were first launched more than 30 years ago to offer investors broad equity market exposure. Traditional passive ETFs do this by delivering the performance of well-known indices like the FTSE 100 – often by indiscriminately replicating it. Since then, the ETF market has continuously grown and evolved. Today, an extremely broad range of both conventional and more complex ETF securities are readily available across different asset classes, geographies, sectors and more. Long synonymous with passive investing, more recent years have seen increasing demand for active exchange traded securities – instruments which allow investors to continue benefiting from efficient, cost-effective market exposure, while also offering the benefits that an element of active investment management can provide.

It is important to appreciate that an ETF is essentially a wrapper which packages underlying investments inside a single, exchange traded security. Crucially, this enables intraday liquidity for investors. Rather than one daily dealing point, as is usually the case with other types of fund, such as Unit Trusts, ETFs can be traded throughout market hours at a known price.

ETFs were not strictly developed for passive investment strategies only – despite this being by far and away the area with which they have become most closely associated. An active ETF, therefore, provides investors with access to non-passive strategies, requiring active intervention on the part of a manager, while maintaining the attributes of the ETF structure. As with other active investment funds, the approach allows the fund manager to implement their own tactical allocation decisions, while also facilitating the delivery of specific investment objectives. For example, seeking to generate high levels of income, or actively managing duration (interest rate sensitivity) risk within a fixed income strategy.

While classic, passive, ETFs facilitate broad exposure across different assets, regions, sectors or even specific themes, there has for some time been further innovative development within this space - bringing to market the likes of factor based or Smart Beta ETFs. Such securities still tend to align with certain market indices, but tilt the underlying holdings towards, or away from, certain desirable / undesirable characteristics. The ETF therefore incorporates a rules-based system to select the underlying investments, based on specific, pre-determined metrics – such as dividend yield, a specific measure of valuation, volatility, or levels of gearing (debt relative to equity), for example. One example here is the S&P 500 Low Volatility Index, where the primary benchmark is the broad US equity market - as measured by the S&P 500 index - but the ETF follows is a subset of stocks which exhibit low levels of market volatility – an alternative index which measures the performance of the 100 least volatile stocks in the S&P 500, with constituents weighted such that the least volatile stocks receive the highest weighting.

Smart Beta ETFs, therefore, use factors such as value, growth, or volatility to deviate from traditional weighting methodologies - such as market capitalisation within equity indices - when it comes to allocating to the underlying assets they seek to provide exposure to. This can perhaps be thought of as a hybrid, active-passive, approach to ETF provision. It is still largely passive, with no active investment decision made beyond the rules for inclusion within the index being tracked. An investor may well believe that a certain Smart Beta ETF will outperform the primary index, but there is an acceptance that this may not be the case if market conditions do not favour particular factors. Furthermore, investors allocating to Smart Beta ETFs are often not primarily concerned with relative performance, but simply want exposure to certain factors within a broader portfolio – usually with the expectation that this will improve risk-adjusted returns.

An active ETF, on the other hand, will not seek to track any benchmark index. Instead, a portfolio manager or a quantitative model will actively pick investments within a certain opportunity set (US equities for example) and seek to generate alpha (excess returns over and above that of the broad benchmark index).

There are essentially two key types of active ETF: Enhanced Index and Bespoke Index. The former combines aspects of passive and active investing in an effort to outperform a benchmark index, while maintaining a low (sub 2%) tracking error. It is still based around a traditional index, but uses active management techniques, including proprietary research, to identify opportunities and generate alpha as well as better risk-adjusted returns than a passive index fund. Bespoke Index active ETFs, on the other hand, see a named fund manager afforded full discretion to use their experience, skill, and resources to construct a custom-built index designed to meet specific investor criteria - such as achieving particular objectives, or exploiting certain market themes. No systematic processes are employed. A bespoke index ETF is therefore generally a more personalised investment solution, often created for a particular investment mandate. The approach may well use a traditional index as a benchmark and starting point for portfolio construction, as well as performance comparison purposes, but the aim is squarely to outperform the index return after costs, and there are no tracking error constraints placed on the manager.

Active ETFs clearly provide many of the key benefits of conventional ETFs; portfolio transparency and intraday liquidity being perhaps the most significant. Active ETFs are also widely available to investors. They are listed on multiple exchanges, and often available in various currencies. Where active ETFs clearly differ is that the active management approach provides the potential for outperformance (and underperformance) relative to the benchmark index. Smart Beta ETFs offer the same potential, but where active ETFs go further is that their structure also allows for prompt, pro-active, adjustments when market conditions demand it. And some active ETFs can also be tailored to meet bespoke requirements and target specific outcomes, as outlined above.

Passive strategies still dominate the ETF market, with more than $13tn allocated across the US and Europe, versus just $1.2tn in active ETFs . However, asset managers are now launching active ETFs at a record pace, with professional services firm, Deloitte, projecting that active ETF assets under management in the US will grow to $11tn by 2035 . Indeed, according to Bloomberg, there is already a greater number of active ETFs in the US than their passive counterparts. While the US active ETF market remains a clear leader in the field, there is plenty of evidence they are now gaining significant traction in Europe too.

Given how synonymous conventional ETFs have been with passive investing - and the growth in low-cost passive investing which they have helped to facilitate - the very concept of an active ETF even might seem incongruous. Proponents of passive investing argue that most active managers rarely outperform their benchmarks after costs and therefore offer investors a sub-par outcome. Indeed, by definition, the ‘average’ active manager will perform broadly in line with the index. That said, many active managers do justify their management fee, and conventional passive strategies have well-known drawbacks too.

Traditional market capitalisation weighted equity securities, for example, will typically ‘own’ the whole market, regardless of whether companies are good, bad, or average. Therefore they can exhibit momentum as they allocate increasingly to the best performing stocks in the index - potentially becoming quite concentrated in a relatively small number of stocks as a result. By default, a market capitalisation weighted equity index is an index of yesterday’s ‘winners’. The companies may well continue to do well for some time into the future, but if sentiment were to turn the momentum investors enjoyed on the upside can quickly switch to strong downward momentum.

An active manager, of course, will seek to allocate increasingly to stocks they believe will do well in the future, and might therefore be better able to preserve capital when the broad market is falling. The arguments in favour of, at least an element, of active management in the fixed income and alternatives spaces are perhaps more compelling than within equities – where opinion as to the best approach is often divided or mandate dependent.

As alluded to, the advent of Smart Beta ETFs was, in part, an attempt to address some of the drawbacks associated with traditional passive securities. Investor demand for efficient, low-cost, access to markets is seemingly insatiable, and product providers can be fairly confident money will be allocated to their innovations in this space if these address a drawback of passive investing, while not increasing costs. The advent of active ETFs was perhaps then an inevitable development. While active ETFs can be slightly more expensive than their passive counterparts, they remain cheaper than more traditional active funds on average, while retaining the wider benefits of the ETF structure.

The TrinityBridge Tactical Passive Fund range has always taken an ‘active-passive’ approach to portfolio construction; active and dynamic asset allocation, fulfilled with cost-efficient, predominantly passive, securities. This sets the Fund range apart from many other multi-asset passive solutions, which periodically rebalance their asset allocation back to pre-determined weightings. Stock selection wise, the Funds have long allocated to tilted and systematic passive securities (boxes 2 and 3 in the graphic above) in an effort to improve risk-adjusted returns. Furthermore, the funds have also utilised Enhanced Index active ETFs (box 4 in the graphic) since 2022. The inclusion of such securities within a wider portfolio can further enhance risk-adjusted returns while staying true to the low-cost, passive, mandate investors have entrusted the funds to deliver. Bespoke Index active ETFs, however, fall foul of these parameters, and while there is undoubtedly a broad market for them, they do not currently fit the bill for the TrinityBridge Tactical Passive Fund range.

Important information

The information contained in this article is believed to be correct but cannot be guaranteed. Past performance is not a reliable indicator of future results. The value of investments and the income from them may fall as well as rise and is not guaranteed. An investor may not get back the original amount invested. Opinions constitute our judgment as at the date shown and are subject to change without notice. This document is not intended as an offer or solicitation to buy or sell securities, nor does it constitute a personal recommendation. Where links to third party websites are provided, TrinityBridge accepts no responsibility for the content of such websites nor the services, products or items offered through such websites.

Before you invest, make sure you feel comfortable with the level of risk you take. Investments aim to grow your money, but they might lose it too.